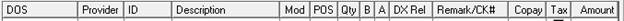

It is very important to know the purpose of each Column on the Transaction window in order to maximize the use of the Transaction window. The Column Headings are shown below (figure 18), as are the descriptions of each Column function

Figure 18

DOS

This is the Date of Service. When the window is opened, the system defaults to enter the current date. If it is necessary to enter a different date, such as when a transaction from a date in the past needs to be entered, there are 2 options.

•Double click in the Column on the DOS line to open the Calendar. Click on the appropriate date, and that will be entered for that line item

•Click once in the DOS field on the line where the date should be entered, tap the Delete key on the keyboard to remove the current date, and type in the appropriate date.

NOTE: If the date is changed on the first line in the DOS field before any products or services are entered, then ChiroOffice will use the Changed Date as the Default Date for the additional entries made. After the Transaction is Saved, the system returns to using the Current Date as the Default Date.

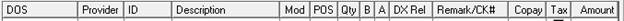

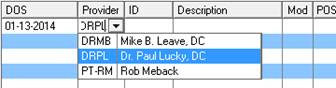

Provider

Each Provider in the practice that has been entered in the Provider Catalog was assigned a Provider ID. This Provider ID is displayed in the Provider Column on the Transaction window. In multi-provider practices, the assignment of the Provider ID on this window identifies which Provider is the one that gave the services or products to the patient. In turn, this determines which Provider is responsible for generating the income, and which Provider should receive payment for the services and/or products.

In multi-Provider practices, it is sometimes necessary to reassign a specific line item (service or product) to a different Provider. This is accomplished by clicking in the Provider field on the line item that needs to be changed. A drop down arrow appears (figure 19). Click on the drop down arrow to see the list of all the Providers, and then click the Provider that should be assigned to that line item.

Figure 19

ID

The ID column displays the computer’s ID for the product or service, or accounting code that applies to the entry made on this line item. If an entry needs to be made but the code is not known, double click in the ID field on the line on which the item needs to be entered. This opens the Procedure Pick List window (figure 20) and enables the selection of the appropriate accounting, product, or service item.

Figure 20

Once the Procedure Pick List is open, click on the Plus (+) sign or Book that is to the left of the category that includes the service, product or accounting code that is needed. Once the item is found, double click on it. This will enter it on the Transaction window.

Description

The Description is the name of the product, service or accounting code as it was entered in the Procedure Catalog. In the event that it should appear differently, not only in the Transaction window, but also on the Transaction Report, Patient Statements and Insurance Claims, it can be edited in the Procedure Catalog.

Mod

Mod refers to Modifiers. Should a Modifier be needed on an Insurance Claim, and it was not previously entered in either the Procedure Catalog or the Intelli$ense Fee Schedule for automatic generation, then it may be manually entered in this column. Simply type it in.

POS

POS refers to Place of Service. This is the location of where the services were provided to the patient. It appears in box 24 B of the CMS-1500 insurance claim form. In ChiroOffice, it is entered in the Procedure Catalog. The list of potential locations has been set by the government. It is not possible to modify the selections.

Qty

Qty is the number of Units (or quantity) of a product or service that has been given to the patient. This number may be pre-set in the Procedure Catalog, or it can be manually typed in. If there is any item, product or service, that has been provided to the patient 2 or more times on a specific visit, then entering the number of Units complies with insurance rules and regulations. However, if the same item is entered on 2 different lines for the same date of service, it is likely to result in a rejection by the insurance company.

B

The B column identifies who the charges for that line item are Billable to, either the patient or an insurance company. On the lower left of the Transaction window is a box listing all the Active insurance programs that apply to this patient. In the Active Insurance Carriers box there is also a B column. If the charges are to be applied to the patient, there will be a “P” for patient in the B column. If the charges are insurance responsibility, then a number “1”, “2”, “3”, or “4” is entered to identify which insurance carrier in the Active Insurance Carriers box the fees will be sent to.

A

A refers to whether or not the practice is accepting Assignment for this charge. In other words the entry in the column determines whether the insurance carrier is supposed to pay the practice or the patient. In the patient’s Insurance Policy window, if the boxes to Accept Patient Assignment and Gov. Assignment have been checked, then there will be the letter Y in the A Column. If those boxes are NOT checked, there will be the letter N in the A Column, designating that the insurance company will pay the patient.

DX Rel

To the left of the Suppress Visitometer checkbox is the Current Dx tab (figure 12). If the practice is NOT using Smart Pointer for Automatic Diagnosis Pointing, then the combination of the Current Dx tab with the DX Rel column in the New Transactions window enables the staff to do manual Diagnosis Pointing. If Smart Pointer is in use, then the DXRel will be entered automatically. Note that the doctor must establish very clear rules for a staff member to perform Diagnosis Pointing. Smart Pointer will be discussed in depth in the next chapter of this manual.

Click on the Current Dx tab to open it. This displays the patient’s current list of active diagnoses in the numerical sequence in which they will appear on the CMS-1500 for insurance claims. For each line item on the Transaction tab, type in the line number for the diagnosis (or diagnoses) that apply to that service or product. It is best if each line item is assigned a different diagnosis. This is important because many insurance carriers use the diagnosis codes to bundle services, provided that the practice has bundled all the services by applying all the diagnosis codes to all the services and products.

Bundling means that all the services provided by the practice would be grouped according to the lowest paying benefit. Example: some insurance programs place a restriction on “spinal manipulation” allowing very few visits. If all the services provided in the practice to a given patient are tagged with all the diagnoses, then once the spinal manipulation benefit has been reached, all the services and products are then denied. However, if each service or product is connected to a different diagnosis, then the services are NOT bundled, and although the spinal manipulation benefit will still end, the other services may be covered under a therapy benefit and continue to be paid.

The bottom line is the Diagnosis Pointing may increase patient compliance as well as the practice income and patient visit average.

Remark/CK #

Depending on the management of the practice, it is frequently required to enter Remarks and or Check Numbers at the time payments or other entries are made. This helps to identify exactly what that line item was used for. This item must be entered manually by typing into the space provided.

Copay

This is the amount that is automatically transferred from insurance responsibility to patient responsibility. It is entered in the patient’s Insurance Policy Billing screen as either a percentage of each line item of entry OR as a specific dollar amount that applies to the visit. On the Transaction window there is the option to override the pre-set amount by clicking into the Copay column and typing in the amount.

Tax

If the practice is required to collect Sales Tax for any product or service, then this box should be checked. If the Sales Tax rate has been entered in the Provider Catalog, and the box was checked in the Procedure Catalog indicating that this item is Taxable, then ChiroOffice will automatically calculate and add on the Sales Tax. This means that an additional line item will appear in the patient’s Ledger and the Sales Tax amount will be added to the Front Desk Collections box at the top of the Transaction window and it will be displayed in the Sales Tax line in the Patient, Insurance and Total Balances box at the bottom of the window. When needed, the practice will be able to generate the Sales Tax Report to know how much had been collected and now needs to be sent in to the tax authority.

Amount

This is the Amount of the fee the practice charges for the product or service, and it is also the Amount of payments received from the patient. When the patient makes a Cash or Check payment, the Amount must be typed in. If the patient makes a Credit/Debit Card payment, and if the practice is using X-Charge Card Services for processing, then the line item will be entered automatically, showing the last 4 digits of the patient’s card number and the approval code in the Remarks column and the Amount paid in the Amount column. If any other merchant card service company is used, this information will need to be typed in.